Introduction

Incurred Cost Submissions (ICE) are a critical issue for government prime contractors, engaged in cost-type or time-and-material (T&M) contracts. Understanding the intricacies of ICE is essential for compliance and financial accuracy. This article aims to provide a comprehensive overview of ICE requirements, common issues faced by contractors, and how WrkPlan can streamline the entire process.

What is the Incurred Cost Submissions (ICE) and Why is it Important?

The Incurred Cost Submission, also known as Incurred Cost Proposal (ICP) or Indirect Cost Rate Proposal (ICRP), is mandatory for contractors holding federal cost-reimbursable or T&M contracts and is a universal requirement regardless of agency customer.

These submissions are the tool by which the provisional indirect rates billed during the year can be reconciled with the actual costs incurred. Under these contracts, contractors bill costs incurred using provisional or estimated indirect rates. The ICS allows contractors to “true-up” their contract account using the actual rates to ensure that contractors are reimbursed accurately for allowable costs. The ICE reports will be the basis for the final close-out audit for the contract.

All contracts requiring the incurred cost submission will include the Federal Acquisition Regulations “Allowable Cost & Payment Clause” (FAR 52.216-7) and/or the “T&M Payment Clause” (FAR 52.232-7)

Requirements for Submitting an ICE

Most prime contractors are working on their ICE right now for a June 30 deadline. The ICE submission must be filed within six months after the end of the contractor’s fiscal year. For example, if a contractor’s fiscal year ends on December 31, the ICE must be submitted by June 30 of the following year. The submission includes several schedules that detail indirect expense rates, direct costs by contract, and other financial data necessary for the Defense Contract Audit Agency (DCAA) to audit and approve the rates.

Key schedules in an ICE include:

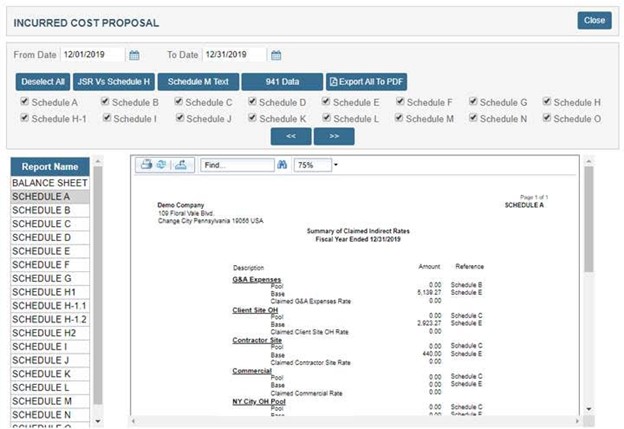

- Schedule A: Summary of indirect expense rates.

- Schedules B through E: Presentation of indirect cost pools and base components.

- Schedule H/H-1/Summary H: Presentation of direct cost by contract at the funding or billing level

- Schedule I: Presentation of the cumulative cost incurred, cumulative billing, and calculation of over or underbilling amount.

- Schedules F, J, L, O, Supplemental Schedules: Presentation of various supplementary information including cost of money, subcontractor information, reconciliation to payroll information, contract close-out data, executive compensation, and other supporting information necessary for the audit of the incurred cost submission.

- Schedule K: Hours and amounts on T&M contracts.

- Schedule N: Certificate of Final Indirect Costs

Contractors can prepare for this task by obtaining a copy of the latest model of the incurred cost proposal on the DCAA’s website. This model, in Microsoft Excel, referred to as the Incurred Cost Electronic ICE Model, will tell contractors exactly what their submissions should include and how the information should be prepared.

Common Issues and Challenges

Government contractors often face several challenges when preparing and submitting ICE:

- Adequacy Reviews: Ensuring that all required information is included and correctly formatted can be daunting. The DCAA provides an adequacy checklist, but navigating these requirements is complex.

- Unallowable Costs: Identifying and excluding unallowable costs is crucial. Common mistakes include including costs that do not comply with the Federal Acquisition Regulations (FAR).

- Accurate Record-Keeping: Maintaining precise records of all incurred costs, including labor and overhead, is essential for an accurate submission.

- Timing: Delays in submission can postpone contract closures and final payments, impacting cash flow.

Top 5 Issues in an ICS Audit:

- Contractor Compensation: FAR 31.205-6 establishes benchmarking for compensation reasonableness to industry peers as well as a statutory maximum compensation amount.

- Contractor Labor Categories: DCAA will frequently review billing rates under T&M contracts to ensure personnel charging to labor rates meet requirements for years of experience, education, and other labor category requirements.

- Allocability: This refers to a cost being assigned to a final cost objective based on a causal or beneficial relationship. The subjective nature of this determination frequently leads to audit issues.

- Bonus/Severance Costs: Also linked to FAR 31.205-6, but DCAA consistently questions the costs of contractors who pay these costs without an established policy or procedure governing the payments based on employee performance.

- Adequacy: This is not really an audit requirement but a gate to clear before the audit can begin. DCAA offers an incurred cost adequacy checklist at dcaa.mil which provides information and checks that every contractor should perform before submitting their ICS.

Make Incurred Cost Submission Easy – Use WrkPlan

Almost all the information required for ICE has already been entered in WrkPlan in the ordinary course of business. From this data, plus your 941 tax data, WrkPlan will produce Schedules A thru O of your submission.

- Automated Data Collection: WrkPlan automates the collection and categorization of financial data, reducing the risk of errors and omissions.

- Real-time Monitoring: Continuous tracking of actual incurred cost rates and comparison of billing at provisional rates versus current actual rates.

- Compliance Assurance: The software ensures that all submissions meet DCAA requirements, including the inclusion of all necessary schedules and adherence to FAR guidelines.

- Streamlined Processes: WrkPlan simplifies the entire submission process, from initial data entry to final audit preparation, saving time and reducing administrative burden

- Audit Support: Comprehensive audit support to ensure that all aspects of the ICE submission are defendable under DCAA scrutiny. Any errors or issues can be tracked to and resolved at the source.

Conclusion

WrkPlan offers a robust solution that simplifies compliance with DCAA, FAR, and ICE requirements, facilitating accurate and timely submissions. For contractors looking to streamline their compliance processes, WrkPlan is the ideal partner to mitigate risks and enhance operational efficiency.

For more information, visit https://wrkplan.com/features/incurred-cost-submission/ or call (856) 266-2846.

Sources

Incurred Cost Submission – Everything You Need to Know (CommAudCo Webinar

Preparing incurred cost submission (GovConIuvo)

Preparing incurred cost submission for government contracting financial (Anglin Reichmann Armstrong)

What is the Incurred Cost Submission: What you need to know. (SAt Work Systems)